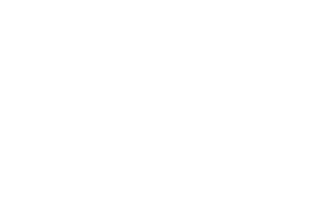

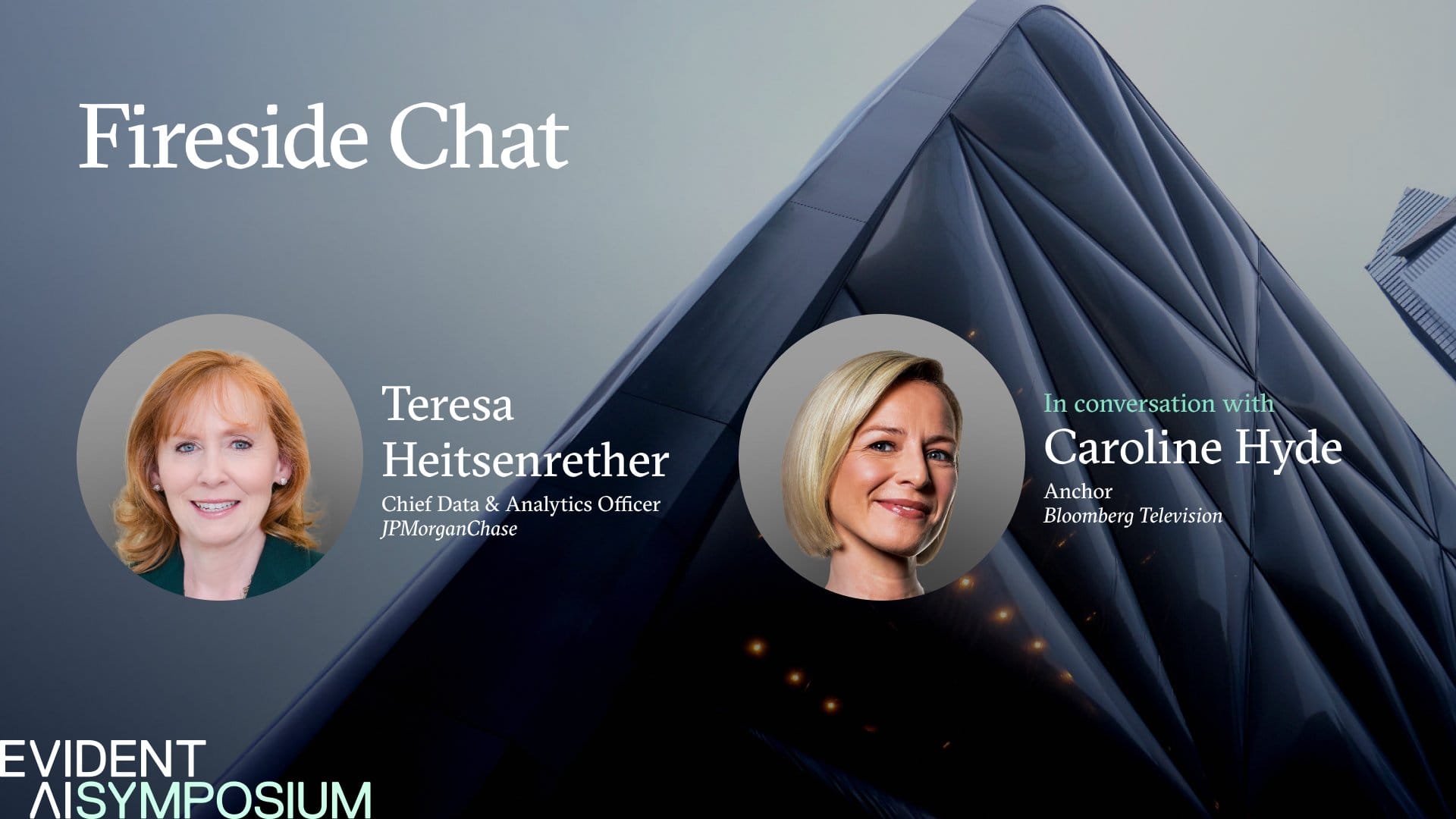

The Evident AI Symposium brought together over 300 banking and insurance executives, innovators, and policymakers for a day of high-impact discussions on AI adoption in financial services, all fueled by data from the Evident AI Index.

Throughout the day, we unpacked the questions that really matter: how to manage risk and optimize model performance, how to embrace cutting-edge capabilities while realizing the value of existing models, where and how agentic systems can deliver on their immense promise, and what the future of the financial services and AI sectors will look like…

Check back soon for archived video of each speaker session—as well as a recap of what we learned from Symposium in our next issue of The Brief.